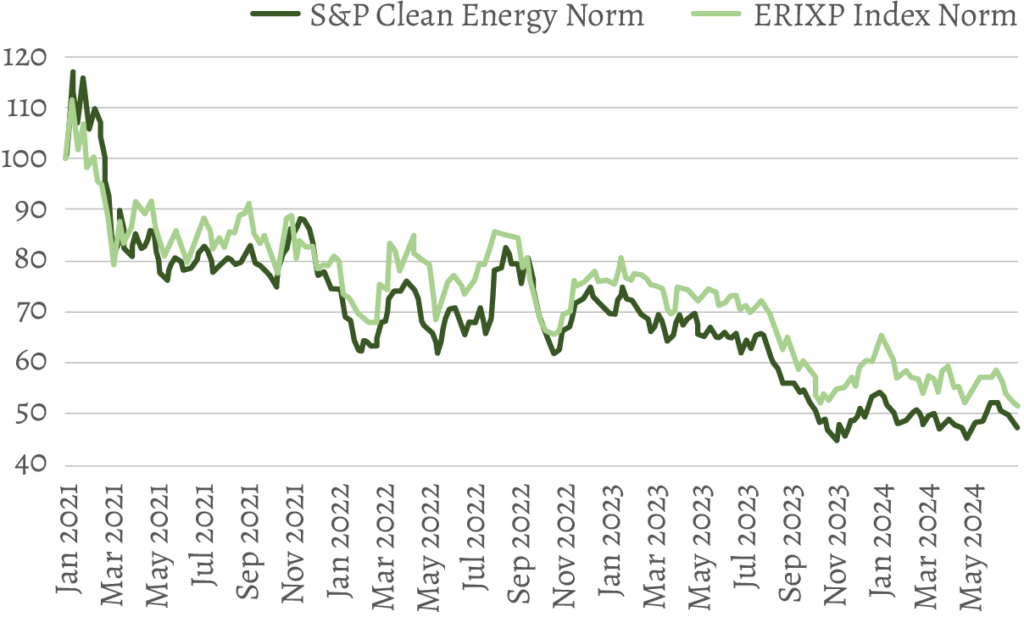

US: -25, -6, -22, -14; EU: -19, -6, -14, -22. We are not giving lottery numbers, which at best would be positive, but rather the annual percentage performances from 2021 to 2024 (for the latter, it’s the performance for the first six months of the year) of the S&P Clean Energy Index and the ERIXP Index, two indices that measure the global and European trends of companies related to renewable energies, respectively.

We are therefore in the fourth year, though not yet complete, of a decline in the renewable energy sector. And it doesn’t matter if we look at Europe, the United States, or globally, the trend of this asset class is similar in every region (see chart).

Renewable Energy

Source: Refinitiv

Yet governments have done a lot, from the Green Deal in Europe to the IRA in the US, to promote sectors related to this theme. Additionally, private investments have also been substantial: in 2023, investments in solar alone surpassed those in oil; when adding other green sources, the difference significantly favors the latter.

So, are we all wrong? Perhaps a distinction needs to be made between traditional financial investors, institutional or retail, whose investment horizon seems not to extend beyond the end of the year, and those who invest because their livelihood depends on energy or because they can afford to evaluate companies in the medium to long term: we’re talking about companies operating in fossil energies, which want to diversify their portfolio by adding more renewable energy, and private equity funds, which seize opportunities that others probably do not see.

Small and medium-sized enterprises entirely operating in renewable sectors, which have been and still are a joy for the short positions of hedge funds, and not only, have reached values so low in recent months that they have attracted the attention of investors interested in alternative energy. Not surprisingly, there have been three acquisition or joint venture operations in Europe over the past three months. In mid-March, the private equity fund KRR launched a takeover bid for the German wind and solar park operator Encavis, at a price that exceeded its market value by 40%. At the end of the same month, SLB, the world’s largest oil services company, signed a joint venture to acquire 80% of Aker Carbon Capture shares at a price almost 60% higher than its market quotation. Finally, in May, the Swedish private equity fund EQT launched a takeover bid to purchase the fellow Swedish company OX2, operating in renewable energies, valuing it 43% more than the market.

To these operations, significant stakes in small and medium-sized companies, still in the renewable sector, by large companies in the fossil field can be added. For example, Equinor, which continues to accumulate Scatec shares whenever the price of the Norwegian company operating in solar and wind in emerging countries falls to values considered low. Currently, Equinor holds more than 16% of Scatec's shares.

These investors, therefore, are paying on average 50% more than market values for these small and medium-sized companies, with the idea of making a profit. One must wonder if they are being too reckless in their dealings or if traditional investors are missing some information.

To get an idea of where the truth lies, we can consider the performance of ETFs related to indices similar to the S&P Clean Energy, preferred instruments for tracking the performance of renewable energies by traditional investors: in the past two months, this index recorded a performance of +13% in May and -11% in June. This volatility, in such a short period, highlights at least two things: the first is that the approach to this theme is indeed made through generic instruments like ETFs, in which there are often companies developing very different green technologies; the second is that investment in this area seems more driven by emotions than by a vision, whether positive or negative, of the future of these types of energy.